Financial Planning

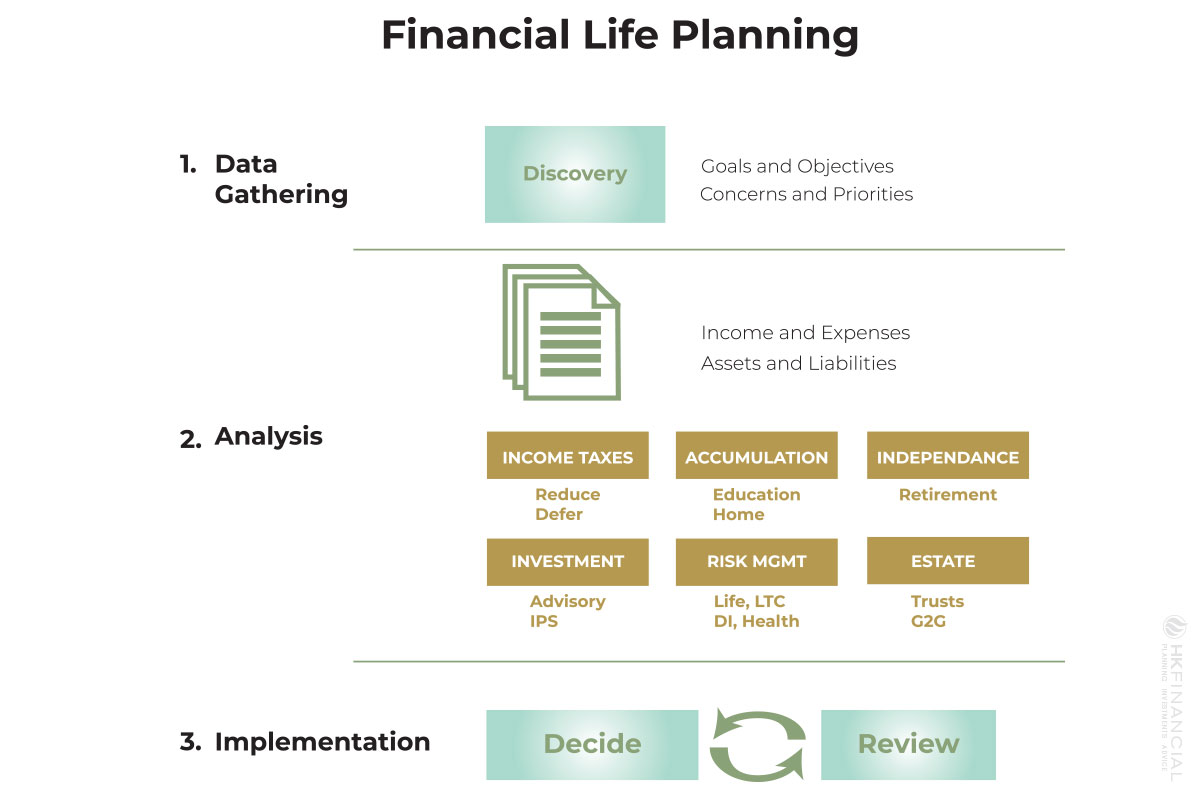

Financial planning is like a big jigsaw puzzle. The pieces can be gathered but only fit together after viewing the picture on the box. We begin the financial planning process by listening to you to understand what your picture (goals and objectives) look like.

During working sessions, we help you discover and prioritize your goals. These may include financial independence, education funding, charitable giving and more, for you and your family. After gathering all relevant data, we meet to reflect your present situation.

We then analyze your present situation in the context of achieving your stated goals and objectives. As a result, we present you with an objective financial plan, with specific recommendations. This roadmap helps you take action towards reaching your financial goals.

Financial Planning: Five Key Areas

Our structured educational process results in a holistic plan with an in-depth analysis including the five key areas of financial planning:

- Tax Planning

- Investment Advisory

- Financial Independence

- Risk Management

- Estate Planning

We offer the service for a flat quarterly fee which includes Investment Advisory Services. This way, you know what you will pay avoiding conflicts of interest.

Our customized financial plans begin listening to our clients to identify their primary concerns as well as goals and objectives. Once goals are achieved, new ones are set and monitored until achieved using “Blue Box” communication.

We’ll develop multi-year cash flow models in which short- and long-term expenditures (tax payments, new residences, children’s education, retirement, etc.) are anticipated and appropriately funded. At the same time, we’ll model cash flows that can be available to fund investment strategies.

Through a thorough review of tax planning opportunities, we can proactively plan financial transactions to minimize current and future tax liabilities. We will coordinate and collaborate with your CPA to ensure your personal, corporate and fiduciary federal and state income taxes are appropriately prepared.

We’ll review your current retirement plans to maximize accumulations while minimizing taxes on distributions. We’ll analyze whether you’re “on track” for your targeted financial independence goals.

We’ll analyze your individual current personal and employer-provided insurance coverage, as well as, your capital needs to determine the optimum level of life, disability insurance and/or Long-Term Care insurance. We will also review your property/casualty coverage including homeowner’s, auto, and umbrella liability contracts.

Effective coordination of the transition of your business to your successors is critical to ensure its continued success once you decide to remove yourself from the company’s day to day operations. We help you address the complex issues of business continuation and can assist you in developing a strategically sound plan.

We’ll analyze your current portfolio to ensure that the mix of assets is consistent with your financial objectives. We evaluate your risk tolerance and present and future income needs to determine appropriate anticipated yields as well as relevant tax strategies. Then we’ll suggest a specific asset allocation then adjust the portfolio as needed.

We will work as a team with your estate planning attorney to develop alternative gifting strategies to generate current or deferred income and tax savings. These strategies may include the use of Charitable Trusts or other vehicles to help you achieve your desired vision. Once you have secured your income and that of your family, you may consider establishing a Family Foundation, Donor Advised Fund or another Charitable gifting program to give back to society while keeping the family involved during your lifetime and beyond, thereby leaving a legacy for generations to come.

Investment Advisory

Academic research indicates that the majority of portfolio returns is a result of the asset allocation decision and not market-timing or individual security selection.

We believe that markets are largely efficient. Therefore, we spend a substantial amount of time to determine the percentage allocation among the asset classes: cash, bonds, stocks and alternative assets, etc.

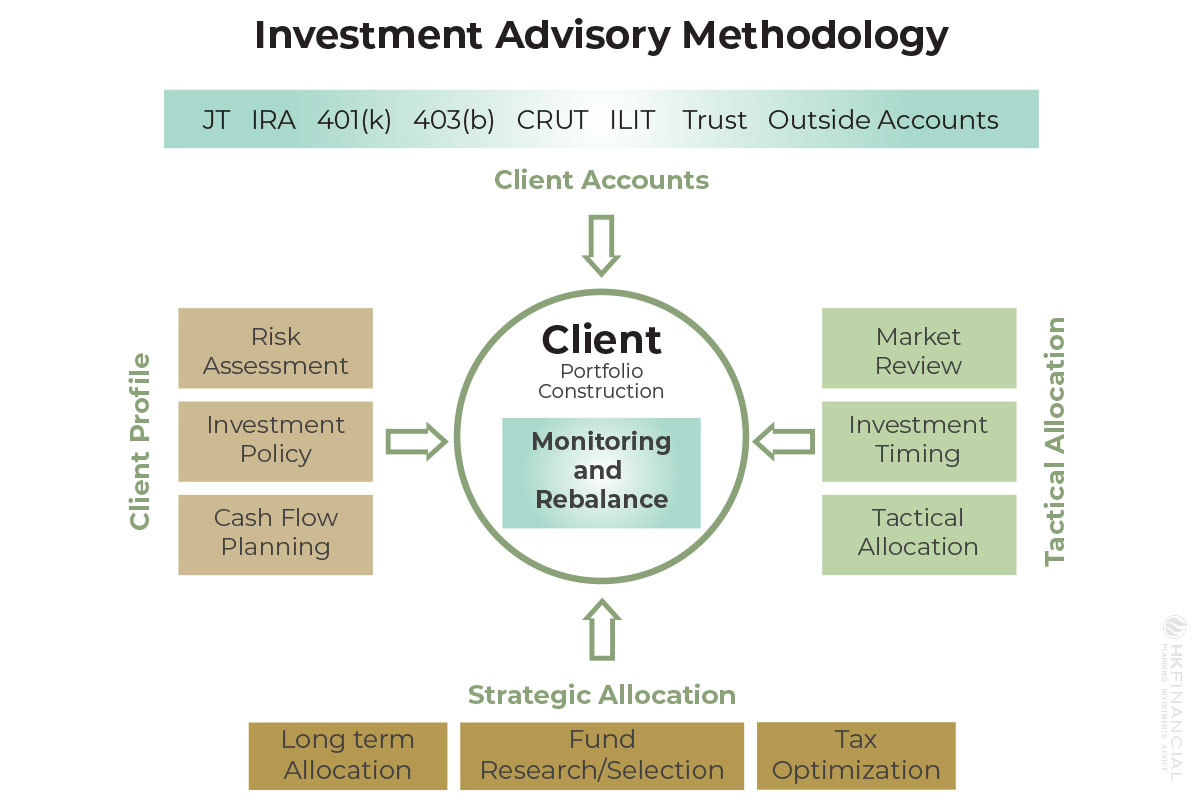

Portfolio Construction is based on four elements:

- A Client Profile is based on a Risk Assessment, Investment Policy, and Cash Flow Planning.

- Existing and anticipated Client Accounts.

- A Strategic Allocation that includes a long-term allocation, Fund Research and Selection, and Tax Optimization .

- A Tactical Allocation that includes a Market Review, Investment Timing and a Tactical Allocation (if appropriate).

Periodic Monitoring, Review, and Rebalancing

We offer the service for a flat fee for those that engage us for Financial Life Planning or based on the Assets Under our Management or Advisement. Either way, we work on a fee-only basis. You know what you will be paying, and conflicts of interest will be reduced.